Argh, this year. I’m hardly original in bidding good riddance to a frustrating and challenging year, though the weight of ongoing pandemic is, in a macabre way, a continual reminder for me to be grateful for continued health and economic security. With the wider distribution of vaccines to the general populace, it’s also easier to conjure up genuine optimism for this coming year.

As is self-prescribed tradition, here are my posts for this year, and 2019’s Year in Review.

COVID-19

2020 will be defined by COVID-19; the open question is how much we’ll feel its repercussions in the years and decades ahead, and in the very long term, how much of the totality of the 21st century will pivot on this singular event.

Some of the initial response to the outbreak was, particularly in western nations, uncoordinated panic and fear culminating in runs on toilet paper1. Subsequent handling of the pandemic has been a mixed bag, with the United States faring worse than most despite our geographic dispersion, where it’s often more useful to think of public health efficacy at a state or even county level2 instead of a national one. And while a lot has been blamed on the lack of coordination at the US federal government, it’s also not completely clear that European countries, with theoretically better coordination, are faring orders of magnitude better. If anything, the countries that have had the most success in controlling COVID have been uniformly aggressive in lockdowns and containment, with most having learned the hard way via previous coronavirus outbreaks.

If the pandemic is indeed pushing the future forward, it has done so indiscriminately and is exacerbating existing societal problems. To be clear, there’s no sugarcoating the suffering borne by people losing their jobs, restaurants and retail stores shutting down, overrun hospitals and ICUs pointing to long-standing health inequities. We went from hoping for a V-shaped recovery early on where the economy would bounce back quickly, to fearing a U-shaped recovery with slower growth, to recognizing now that we’re actually closer to a K-shaped recovery where it looks like only a subset of industries will rebound.

A handful of things this year that have been arguably improved due to COVID’s forced acceleration of trends: the opportunity to rethink and restructure work; a sustained recognition of racial injustices and inequalities; a blueprint for global cooperation on climate change. We should not downplay the enormous amount of suffering and death in these winter months, yet it is a coincidence of cosmic timing that—with the greatest concentration of scientific minds in human history—vaccines developed in record time with extremely high rates of efficacy are now turning the tide in our fight against this cruel virus.

An Unfathomable Stock Market

The stock market is probably the most visible indication of this K-shaped recovery and bifurcation of economies. When the COVID lockdowns were first instituted in March, unemployment rates soared and the stock market tanked; both events made sense, as constraints on physical proximities reduced economic activity and many businesses thus lost customers and revenue. Other than a handful of technologies that stood in as replacements for physical presence—hello, Zoom—most companies were either immediately impacted, or anticipated second-order negative effects.

But something strange happened in the summer: stocks rebounded to their previous levels and then kept going up as if the pandemic didn’t matter. The ex post facto explanations have been that investors are an optimistic bunch, looking ahead to vaccines and stimulus packages and bidding up prices now in anticipation. Other plausible theories encompass everything from persistently low interest rates driving investors to equities for returns, to the Fed injecting massive amounts of dollars into the markets3, to unpredictable amateur trading by retail investors propelled by easy-to-use apps and a lack of fees plus general lockdown-induced boredom.

Whatever the reason, one net effect of this market bubble is that capital suddenly looks cheap with public investors, moreso than private investors at this point in time. In my corner of the world that is startup-land, this dynamic has pushed a surprising amount of private companies to IPO this past quarter with more to come in early 2021. The cherry on top of this ridiculous cake is that these emerging companies have been met with unfettered demand, which has only pushed prices higher, with implied valuations further decoupled from business fundamentals. Naturally, startups are now rushing to take advantage of this opening of the public markets—including my former employer, Affirm.

New Job, New Role

Speaking of which, 2020 is also the year I took another step in evolving my own career. I had been an engineering director at Affirm for the past 3½ years, and in that time built and ran a number of engineering teams, everything from web infrastructure4 to mobile app development to banking system integrations. Between Affirm, Square, and my job out of school at FactSet Research Systems, about ⅔rds of my career up to this point has been with FinTech companies and startups, though it wasn’t something I had planned when setting out to work in the tech industry.

While my family and I are still very fortunate to be economically secure and in good health in this pandemic, it has taken a toll; parenting and homeschooling young children has been a complicating stressor throughout this time we’ve been stuck at home. We’ve rearranged work schedules, taken extended time off, juggled meetings and IT support for Zoom classroom gatherings, and tried to make do with limited physical activities outside of the house. We ended up opting to skip summer camp and daycare, and I took a real break from full-time work—legitimately, and not euphemistically like how press releases frame executive departures—to recoup and hang out with the kids5.

I did eventually find an exhilarating new role, though: I’m currently working at Mystery.org, building products to help kids stay curious. It’s admittedly my first foray into the EdTech space, but one that I’ve been wanting to dive into, particularly as my own kids are reaching those ages when they’re sponges for new information and the quality of their learning and schooling sets the trajectory for, potentially, the rest of their lives. Our company’s main product is teaching tool dubbed Mystery Science, and I can attest to its product-market fit; my son and his friends voluntarily and routinely stream its lessons as a part of their virtual play dates.

The other exciting aspect of my new job is that I’ll be taking on a more expansive role with the Mystery team. Whereas I’ve been managing (incrementally bigger) engineering teams in the past, my role at Mystery charges me with overseeing our technology function as a whole—including aspects of product, engineering, design, and data science. Those adjacent disciplines have always been close collaborators with my prior engineering teams, but a formal reporting structure adds a new dimension of responsibility. It’s still early, but I’m enjoying the deep dive into the state of education and how technology can play a role in improving the quality of learning for teachers and students.

Introspection

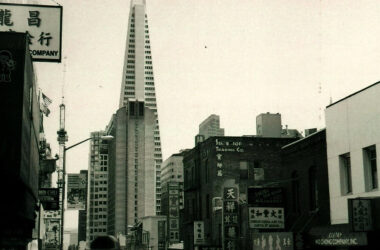

For many, living in the same space for months on end has been the height of tedium. Many of my colleagues decamped from San Francisco to more open spaces eastward; others dialed in to more at-home entertainment to keep themselves distracted6. I’m hardly immune, as I’m also making an effort to whittle down my backlog of well-regarded shows and movies.

But beneath the various memes from the early days of the pandemic—of how sheltering-in-place was actually a godsend for introverts like myself—is an underlying truth: the added environmental familiarity allows for further introspection. I’ve been taking advantage of this, using the quiet times for more reading and blogging7 and journaling and career planning and developing healthier habits (that last one with varying degrees of success). In updating and summarizing what my writing here is ultimately about, peering inwards and rearwards feels…natural. Preordained, almost.

Unfortunately, all this reflection has not resulted in any personal breakthroughs; they’re more along the line of new threads that are available to be tugged on for years to come. And that may be the underwhelming lemonade squeezed from the lemon that is this miserable year: to have survived, and in that survival develop added resilience for a hazy future.

It says something about our societal values that one of our collective reactions to disaster is ensuring our butts stay clean.↩

California, for instance, adapted a tiering system by county for measuring virus spread and set policies around reopening the economy on that basis.↩

Which ought to lead to elevated inflation rates; the tricky part is that we’re just not seeing inflation go up either.↩

Front-end tech still holds a soft spot in my heart, even if the frameworks keep changing every 2 years.↩

I also made progress on my personal todo list, some items which were there for 5+ years!↩

Hence the bullish outlook for gaming companies and streaming video services.↩

Well, maybe not more, but hopefully slightly better writing.↩