This past week, Tesla announced that in order to offer their Model 3 at the previously-promised $35k price point, they’re taking the radical strategy of shuttering the vast majority of their physical stores, moving all their cars to online ordering. It certainly feels like a move to shake things up, particularly as the first rush of Model 3 orders get mostly filled, while the federal EV tax credit is finally starting to wind down.

In many ways, Tesla is well-positioned to try something like this. Their precarious cash reserves and dwindling demand—at least in the US—may be forcing functions for action, but the company has famously fought car dealerships for the rights to sell and service its own vehicles, and ridding itself completely of physical stores is a natural extension. At the same time, both Tesla and its buyers and fans tend to be pretty tech savvy1, so there’s nobody better suited to at least try to make online-only car store work.

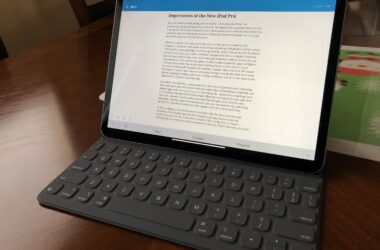

In removing its stores, Tesla is betting that its buyers will buy their cars much like how they buy other big-ticket electronics: do their research online, ask friends if needed, then place their orders and then either pick it up or have it be delivered. I remember that when we picked up our Model 3—sight unseen, without so much as a test drive—the associate remarked how much it should feel like buying and using a smartphone, playing up the intuitiveness of the interface and overall experience.

Covering the other functions of the traditional car dealership are a mixed bag. The test drive story is shaky; with no vehicles parked in stores for test drives, the company is instead introducing a 7-day, 1000-mile full refund policy on vehicles sold, but buyers who try to actually return their cars report major customer service issues. On the positive side, EVs have fewer moving parts compared to traditional gas-guzzlers and so generally require less regular service2, and even there Tesla has invested in its own mobile servicing fleet, completely displacing the dealership servicing model.

Other car manufacturers are locked into their relationships with their dealership networks, however. But even there, it’s been interesting to see how manufacturers are trying to route around their dealers, via programs like direct-to-owner vehicle subscriptions. Volvo is probably the pioneer here, actually launching and selling out its Care by Volvo XC40 subscription program in its first year, and it has plans to double down on that strategy with its own EV, the Polestar 2, which will only be available via subscription. Other luxury car makers have their own programs as well, though the monthly costs are so exorbitant that they’ve mostly priced themselves into a niche at this point.

Putting on my business hat for a moment, this shift in attitude from car makers towards direct-to-consumer services makes total sense. Car dealerships exist primarily to provide servicing and distribution to the manufacturers, and—if this Quora answer is to be believed—make decent profit margins. With incoming EVs diminishing some of the servicing needs and technology that reaches the end buyers directly, the middleman in this transaction is starting to find itself disintermediated; the makers have this chance to both capture those profit margins for themselves, as well as leverage their own strong brands to the end-consumer experience and bypass the unsavory reputations of dealerships altogether.

To be clear, we’re probably still many years, if not decades away from dealerships becoming truly obsolete. Some predict the end of car ownership itself as the endpoint for dealers, but I think that’s further away than people think, and I hope that we get rid of dealerships well before then due to the aforementioned combination of technology and business alignment. As with EVs themselves, Tesla is taking a bold first step, and it’ll be on the rest of the industry to respond.

It can be unsettling, even for someone who builds software for a living: it took me about 4 clicks on the website to spend $3000 to buy and enable the Full Self Driving firmware unlock.↩

Given that servicing vehicles is a big part of car dealerships’ revenue streams, the advent of EVs in general feels like it’ll force the industry to evolve regardless of what Tesla does.↩