I typically spend a few minutes every Sunday to go through my finances. This means checking up on credit card statements, ensuring I have enough money in bank accounts to pay for upcoming bills, and estimating whether I should put money in or take money out of the stock market. As far as financial hygiene goes, it’s a good habit as any I’ve tried.

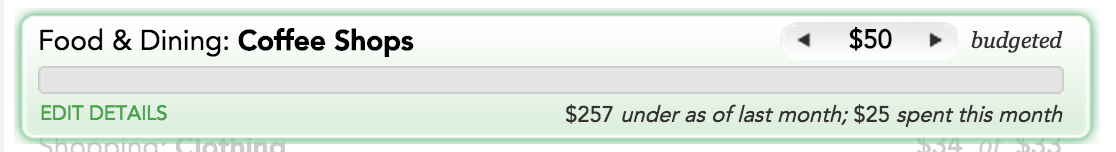

In the midst of the exercise this week, I came across a curious item in my Mint budget overview:

The simple explanation is that I went out and got a bunch of coffee gear a few months ago, with the stipulation that I do not spend money in coffee shops until the amount I would have spent equaled what the equipment cost. My budget for coffee essentially narrowed down to coffee beans, and this was just me forgetting to update Mint’s budget.

Conventional wisdom suggests that budgets and expectations should be updated with the times, that baselines are only useful when they’re in-line with the most updated data. After all, public companies do this dance every quarter for their earnings, and millions are created or lost when expectations misalign.

Then again, having outdated expectations can illustrate the amplitude of change, and it’s a particularly powerful effect when it comes to emphasizing positive change. I knew I wanted to reduce spending on coffee, but didn’t bother to track the reduction explicitly until I saw that I indeed saved some money over a handful of months.

Of course, this is psychologically equivalent to setting your clocks a few minutes ahead of time to fool yourself into leaving a little earlier1; its effectiveness is inversely proportional to how much you’re thinking about the scheme. In this case, temporary, self-induced, controlled ignorance can provide a pleasant surprise.

Or in my wife’s case, setting the clock in her car later to add a sense of urgency in her commute.↩