Unicorns are overvalued.The general trend was obvious for a while: the emergence a glut of companies just clearing the $1 billion valuation mark with special conditions, funds downgrading or writing off their private company shares, and a run tech company IPOs that underperformed in the eyes of financial analysts.

This article and the accompanying academic paper:

Silicon Valley’s Unicorns Are Overvalued

Squaring Venture Capital Valuations with Reality

claim to produce a model that quantifies how much unicorns are priced privately beyond what the public markets think.

Mistakenly, the authors used Square as an exemplatory use case1, and while it was considered a poster child of private valuation exuberance, it’s not clear to me whether that narrative did or continues to hold up. Of course, I also happened to be there through a good chunk of its existence, so I had the motivation to do the research—before the IPO and after—to try to understand the reasoning behind the numbers.

Quick disclamer: I am not employed by Square, and my opinions here represent my own views and not that of the company. I currently own shares of Square.

Misleading Numbers

To start, an immediate problem is the conflation of public market capitalizations with private valuations. This is such a common misconception that a former Square colleague tried to explain the difference, within the context of that IPO. Essentially, market caps exclude options and RSUs; for tech startups, whose employee option pools make up 15–20% of outstanding shares, this is not a trivial haircut in perceived value. When companies were able to IPO earlier in their lives, first-day pops were able to cover up this discrepancy, but with startups staying private through their biggest stages of growth, even if the public valuation matches the private one, this difference in calculation contributes to the “overvalued” narrative.

Moreover, there was much made about the ratchet clause in Square’s Series E funding; those investors were entitled to more shares—hence diluting everyone else—if the company didn’t exit at a certain price. It’s one of a handful of tricks companies use to boost the raw valuation number, and many (including the academic paper) cited this as a major reason startups are massively overvalued. For Square, though, activating this clause did not break the bank: the additional shares ended ended up diluting everyone by only 3%. From reading the paper, you’d think that the whopping 170% difference between Square’s private valuation and eventual IPO price is due to late-stage investors taking enormous chunks of the pie off the table.

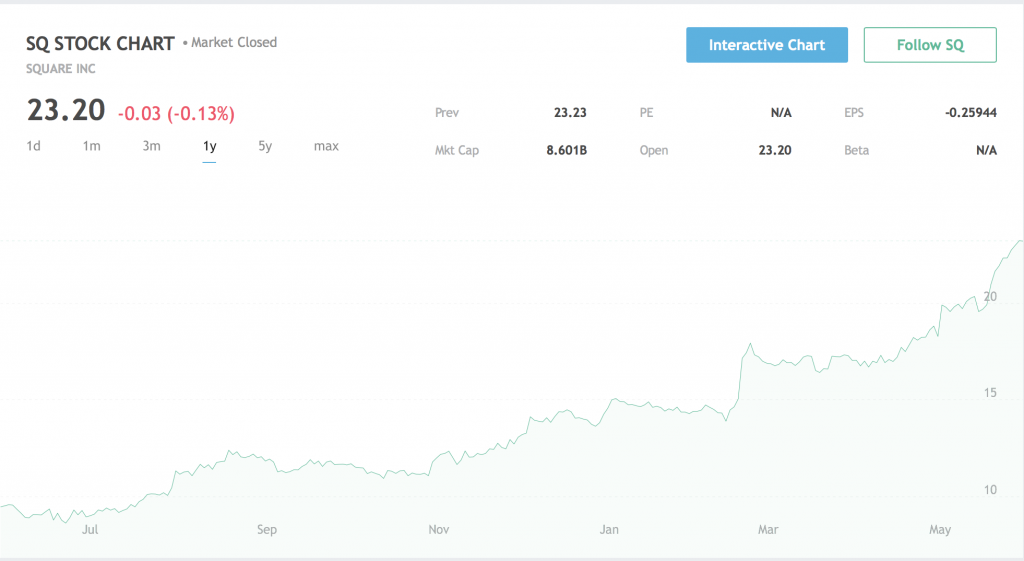

The fact remains, though, that Square was privately valued at around $15.50/share, and ended up listing at $9/share2. In the past year, I’ve accepted that the public markets operate with utter fickliness, so I’ve learned to stop reacting to fluctuations that really harbor no hidden, nuanced meaning. The longer term trend—as of this writing, it’s hovering around $23/share—suggests that the company has left behind the accounting minutae around the IPO, but it’s worth digging a little into that process itself.

The IPO Process

Public offerings are complicated affairs which are puzzlingly opaque to non-bankers. This article on Grubhub’s IPO is one of the best resources I’ve found for understanding what it takes to list on an exchange3.

And while there are plenty of procedures that are required to list, I’d argue that the machinations of bankers are at least a few degrees removed from the actual business itself. In fact, it feels like a bullshit job; they act as gatekeepers to cook the numbers for optics that will be forgotten within weeks (i.e., did the stock pop on the first day?), and charge a hefty toll for that privilege. Famously, Google’s IPO was conducted as an auction to try to route around, or at least minimize how much the bankers were guaranteed to pocket. It’s important to remember that a “weak” IPO isn’t a referendum on business health, and the primary cost of a low public offering number is the amount of money raised for the company.

With that in mind, Square priced at $9, actually opened at $11, and closed on the first day at around $13. This now-expected “first day pop” is a wholly engineered phenomenon, justified as a technique to establish momentum in trading, but becomes irrelevant to the eventual stabilized share price. From an employee’s standpoint, as everyone is under a 180-day lockup period anyway, all the early volatility just sets expectations that may never be realized.

Square’s Business Strategy

Sarah Friar is the CFO of Square, formerly of Goldman Sachs, and she often preached about the weight public markets placed in revenue predictability. Wall Street analysts cared about quarterly earnings and guidance numbers, and a key to success is to be able to hit those targets multiple quarters in a row4. In addition, the street rewards growth and high revenue lines of business, reflected in higher price-to-earnings ratios. For industries with established business models, analysis starts from that known baseline (e.g., restaurants are known to have low profit margins) and get tweaked based on how the company is cutting costs or selling more expensive products.

This system is relevant to Square because since inception, the company relied on payments processing revenue, a commodity business that only makes sense at scale. Square’s big differentiation was establishing a customer-centric brand and building better technologies. but all of that amounted to increasing volume in a low-margin business unless we leveraged the functionality for something more profitable. The strategy had always been to use payments to introduce complimentary merchant services, where the quality of our design and engineering and integration won over customers. This strategy was started in earnest a 1–2 years before the IPO, but I’m still proud of the part I played on our software products.

Explaining the Valuation

When Square decided to chance the public markets, the conditions for tech IPOs was absolutely terrible. Most companies ended up staying put, although some have taken on additional fundraising rounds in lieu of dealing with the pressures of a public company. Even so, Square was vilified as an IPO failure, a startup that took advantage of cheap private investor money and faced its day of reckoning. Looking back from 18 months of public history, plus extrapolating that progress back to when the company was private, provides a more nuanced narrative.

Square had grown a decent business in payments processing: it grew much faster than its older competitors, but by sheer volume was (and is) only a fraction of the size. We had started to build a nascent product line around merchant business software and small business loans, but the books became public at a time when neither offered meaningful contributions to the bottom line. The tall task for the finance team was to convince the public to value the company for a future where software products and services would outpace processing, the same rationale that was priced privately at $6 billion5.

Maybe the timing wasn’t perfect for the IPO itself, but Sarah knew what she was doing: Square beat its quarterly earnings estimates every single quarter save one6. The subsequent strength of the earnings reports and growth of its business services is exactly what public markets reward, and makes the company look like this:

Don’t Fixate on the IPO

One final point: the IPO is a point in a company’s arc. It’s an important event, both for the optics—we’re in the big leagues!—as well as for the sake of employee liquidity, but it shouldn’t be analyzed as a terminal stop for healthy businesses. Employees and investors should want the company to continue to improve its valuation publicly, even if a gradual path to success doesn’t attract singular headlines.

Maybe they just couldn’t help themselves with the pun.↩

It ultimately opened trading at $11/share.↩

It’s worth stopping here to read through the story from that link. Even if you never find your way back here, your time will be well-spent learning what it takes to take a company public.↩

Ensuring predictability is a big reason why startups pull back on new product and business offerings in anticipation of an IPO, which provides enough stability to refine financial models.↩

Minus the difference in options, RSUs and options as mentioned above.↩

It had to write off a one-time settlement payment for a lawsuit, but that made the bottom line look bad, so the stock took a dive.↩